Hard Money Atlanta Can Be Fun For Everyone

Wiki Article

Hard Money Atlanta - The Facts

Table of ContentsThe Only Guide for Hard Money AtlantaAbout Hard Money AtlantaThe Ultimate Guide To Hard Money AtlantaThe Facts About Hard Money Atlanta Uncovered

Since tough money financings are collateral based, also referred to as asset-based finances, they call for minimal paperwork and permit investors to enclose a matter of days. Nonetheless, these car loans featured more risk to the lender, and for that reason require greater deposits and have greater rate of interest than a typical funding.Lots of standard car loans might take one to two months to close, however hard cash loans can be shut in a couple of days.

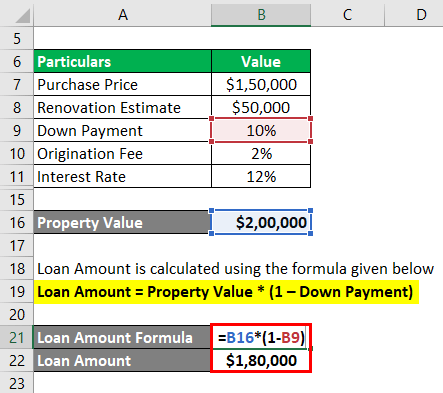

A lot of tough cash fundings have brief repayment durations, normally in between 1-3 years. Traditional home loans, on the other hand, have 15 or 30-year repayment terms on standard. Difficult money financings have high-interest prices. Many difficult cash funding rate of interest are anywhere between 9% to 15%, which is dramatically greater than the rates of interest you can expect for a standard home mortgage.

This will consist of buying an assessment. You'll get a term sheet that details the car loan terms you have been approved for. When the term sheet is authorized, the finance will certainly be sent out to processing. During lending processing, the lender will ask for files and prepare the financing for final car loan testimonial and timetable the closing.

Some Known Facts About Hard Money Atlanta.

You'll need some funding upfront to certify for a hard cash funding and also the physical home to serve as security. In addition, tough cash fundings usually have greater passion prices than conventional mortgages. hard money atlanta.

Typical departure strategies include: Refinancing Sale of the property Payment from various other resource There are numerous situations where it may be helpful to make use of a difficult money finance. For beginners, investor that such as to house flip that is, acquire a run-through house in requirement of a great deal of work, do the job directly or with specialists to make it better, then reverse and also sell it for a higher cost than they purchased for may discover tough money finances to be perfect funding options.

Due to this, specialist house fins typically like short-term, busy funding solutions. On top of that, residence fins original site usually try to sell residences within much less than a year of buying them. As a result of this, they do not require a long-term and can stay clear of paying way too much rate of interest. If you purchase financial investment properties, such as rental buildings, you might likewise find hard cash financings to be excellent selections.

See This Report on Hard Money Atlanta

In some instances, you can additionally utilize a hard cash finance to acquire vacant land. This is a good choice for developers who are in the process of certifying for a building funding. hard money atlanta. Keep in mind that, also in the above circumstances, the prospective disadvantages of hard money financings still use. You have to be certain you can pay off a tough cash car loan before taking it out.If the expression "difficult cash" motivates you to begin pricing quote lines from your favored mobster flick, we wouldn't be shocked. While these sorts of finances may seem difficult and intimidating, they are a typically utilized financing method my company numerous investor use. But what are tough money fundings, as well as how do they function? We'll describe all that as well as more here.

Difficult money car loans generally come with greater interest prices as well as much shorter payment routines. Why select a difficult cash car loan over a standard one?

The Only Guide to Hard Money Atlanta

Additionally, because exclusive people or non-institutional loan providers provide tough cash car loans, they are exempt to the very same guidelines as conventional loan providers, which make them extra dangerous for consumers. Whether a tough cash car loan is ideal for you depends on your circumstance. Difficult money lendings are excellent alternatives if you were denied a conventional car loan and also need non-traditional financing.Contact the skilled home loan advisors at Right Begin Mortgage for more details. Whether you wish to acquire or refinance your house, we're right here to help. Get going today! Ask for a cost-free personalized price quote.

The application procedure will usually involve an analysis of the home's worth and also possibility. This way, if you can not manage your payments, the hard money loan provider will simply relocate ahead with selling the home to redeem its investment. Tough money lending institutions normally charge higher rate of interest than you would certainly have on a typical financing, but they additionally money their lendings quicker as well as generally need much less documents.

As opposed to having 15 to thirty years to settle the loan, you'll generally have just one to five years. Tough cash finances work fairly in a different way More Help than conventional financings so it is very important to recognize their terms as well as what purchases they can be utilized for. Difficult cash financings are typically meant for investment residential or commercial properties.

Report this wiki page